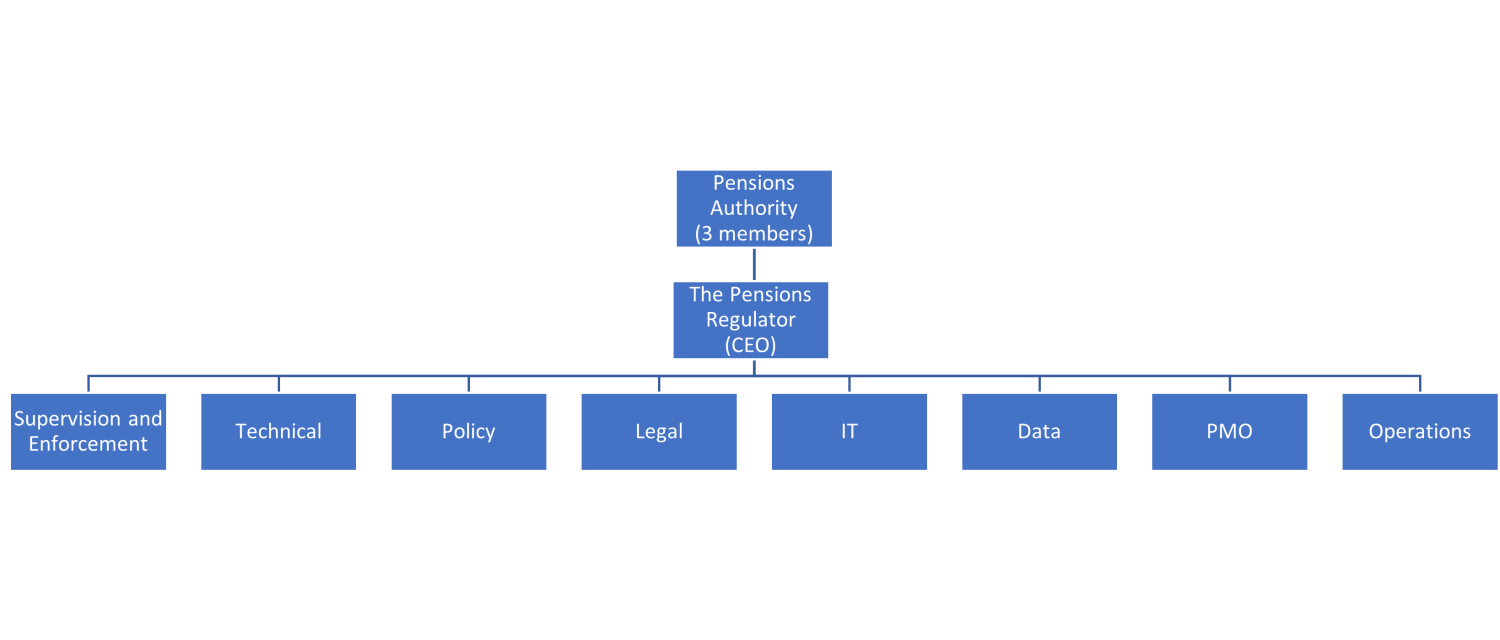

Organisational structure

The Pensions Authority is a statutory body set up under the Pensions Act.

The Authority:

- supervises compliance with the requirements of the Pensions Act, by trustees of occupational pension schemes and trust RACs, personal retirement savings accounts (PRSA) providers, registered administrators (RAs) and employers,

- investigates suspected breaches of the Pensions Act,

- conducts on-site inspections and compliance audits,

- instigates prosecutions and other sanctions where breaches of the Pensions Act are found to have occurred,

- provides policy advice and technical support to the work of the Minister and Department of Social Protection,

- provides relevant information and guidance to the public and those involved with pensions, and

- deals with enquiries received from scheme members, trustees, employers, the pensions industry, the general public and the media.

The Authority is organised as follows:

Pensions Regulator

The Pensions Regulator is the chief executive officer of the Pensions Authority.

Supervision and Enforcement – are responsible for:

- investigating suspected breaches of the Pensions Act and instigating sanctions where appropriate,

- supervision and enforcement activities including on-site inspections and compliance audits designed to ensure compliance with the requirements of the Pensions Act,

- oversight and processing of defined benefit scheme funding and related recovery plans,

- registering and approving PRSA products,

- approving and renewing registered administrators, and

- granting approval for cross-border schemes.

Technical – are responsible for:

- providing technical support and advice to the Authority,

- dealing with all initial information enquiries from scheme members, trustees, employers, the pensions industry and the general public,

- the content of all published guidance, whether advisory or mandatory, and

- contributing to and participating in EU and international pension policy issues.

Policy – are responsible for:

- designing and implementing the changes needed to give effect to the IORP II Directive and the Authority’s proposed pension reforms,

- drafting governance and management standards for pension schemes,

- the development of Authority processes for the ongoing oversight of regulated entities, and

- formulating policy advice on the development and regulation of pensions and related issues through research, consultation and preparation of working papers.

Legal – are responsible for:

- providing legal advice and support services to the Authority,

- prosecuting summary offences and taking other legal sanctions under the Pensions Act, and

- providing secretariat services to the board of the Authority.

Data – are responsible for:

- analysis of data submitted to the Authority from regulated entities,

- collating available data and information, and

- dealing with data queries from regulated entities.

IT – are responsible for:

- the hardware and software infrastructure that the Authority needs to carry out its work, and

- the development and maintenance of the Authority’s software which is used for the supervision of pensions schemes.

Programme Management Office (PMO) – are responsible for:

- overseeing a strategic roadmap of projects for the implementation of IORP II and aspects of the Government’s pension simplification and reform agenda,

- developing project and change management capability as a core organisational competence, and

- ensuring a standard and consistent methodology is used to plan and execute projects.

Operations – are responsible for:

- communications and delivering the Authority’s information to scheme members, trustees, employers, the pensions industry, the general public and the media,

- budgeting, financial management and controls,

- human resources, risk management, procurement and facilities management, and

- overseeing corporate governance and associated policies and processes.